|

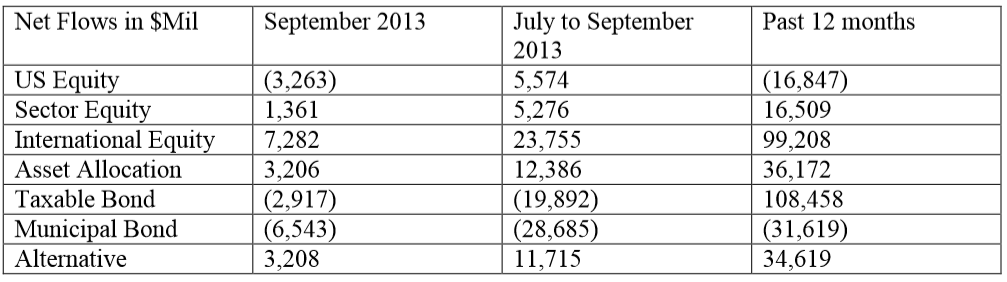

One of the first rules a new financial advisor learns is that success in the business has nothing to do with how well your clients do in creating or maintaining wealth. Success is measured by how much wealth the advisor creates for him or herself. The same rule extends beyond the local advisor to the great halls of institutional management. Jeremy Grantham, the founder and chief investment strategist of Grantham Mayo van Otterloo (GMO) a $100+ Billion institutional manager explained the rule very well in his April 2012 GMO Quarterly Letter titled “My Sister’s Pension Assets and Agency Problems”. Here are the first few sentences: The central truth of the investment business is that investment behavior is driven by career risk. In the professional investment business, we are all agents, managing other people’s money. The prime directive, as Keynes knew so well, is first and last to keep your job. To do this, he explained that you must never, ever be wrong on your own. To prevent this calamity, professional investors pay ruthless attention to what other investors in general are doing. The majority “go with the flow,” either completely or partially. Going with the flow is the second rule a new financial advisor learns to become successful. You sell only those investments your client wants and nothing else. This rule explains very easily why so many individual clients of financial advisors sold all their common stocks in 2008 and 2009 at the bottom of the market and bought bonds, annuities, private placements, non-traded securities and anything else but common stocks until now. This year investors are committing funds to long term equity mutual funds. This commitment, however, is not to U.S. based companies. According to Morningstar data, the estimated fund flows into long term mutual funds through September are: What stand out are the large flows into Sector Equity, International Equity, and Asset Allocation funds while US Equity had large outflows. This is not surprising to me. As Mr. Grantham so clearly stated, a professional advisor “must never, ever be wrong on your own”. The fact is, the best place for your equity investments over the past four years has been US equities. If an advisor suggested you sell your US common stocks at the bottom of the market in 2008 and 2009, then asking you to buy them back today, at twice the price, looks bad. It is much easier to suggest you increase your stock holdings by buying international mutual funds. Of course, this excludes the great global companies incorporated in the United States. Because of this, we wanted to revisit quality investing and strongly suggest that the next few years investing in quality companies many of which are incorporated in the US will be able to withstand the pressure of volatile markets and protect against a permanent loss of capital. Our Definition of Quality Because the idea of “quality” is a value statement that is different for everyone, it is important for me to give you a definition of what we consider “quality” to be in our search for high quality companies to invest in. Our simple definition of quality is a large, excellent business that is financially sound, able to generate large amounts of free cash, and willing to share that cash with its owners over many years. A more extensive list of characteristics we use to define quality is:

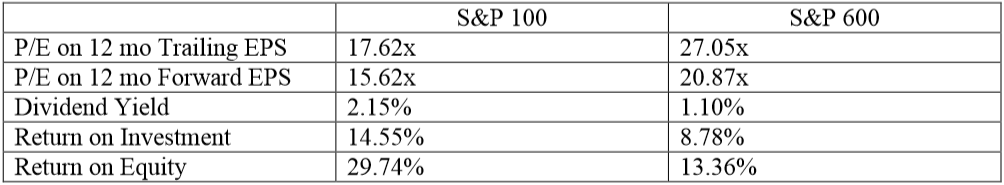

Why quality investing is more important today than ever The economies of most countries are stagnant or growing so slowly that they are not able to employ all of their citizens that want to work. World political leaders are in direct conflict with most of their own central bankers and, in many cases, their own citizens; who have no idea if a great inflation or debilitating deflation is around the corner. We know that wealth disparity is harmful, yet our politicians continue to attack the problems with ideas that have failed for decades. Our businesses around the globe are struggling to play by the rules, but have no certainty in what those rules are today, or will be tomorrow. And to top it all off, the world markets are reacting in sync to specific political and economic turmoil, regardless of its place of origin. During periods of uncertainty the risk adverse nature of high quality companies have historically been less volatile than the market in general. Better yet, they seem to benefit from the known flight to quality nature of investors during major market sell offs and have generally recovered their previous market value shortly after the crisis periods end. A low relative price As you know, we always want to buy low. It is our primary weapon against permanent loss of capital. Today quality has a low relative price compared to the broader markets, especially the smaller growth companies currently in the limelight. The following table compares the S&P 100 with the S&P 600. The S&P 100 is a subset of the S&P 500. Its members are 100 blue chip companies with the highest market cap of those companies that are included in the S&P 500 index. The S&P 600 consists of 600 smaller companies selected by Standard and Poors. It is designed to represent the performance of smaller public companies share price over time. Both the S&P 100 and S&P 600 are market cap weighted. You can buy a represented portfolio of the S&P 100 and the S&P 600 via an ETF or open ended mutual fund. Our table is equal weighted to highlight individual company valuations. Zacks Research Wizard

When we combine a low price with high quality, we have the best of both worlds—at least in my book. Today seems to be one of those times when quality is on sale. Until next time, Kendall J. Anderson, CFA Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed