|

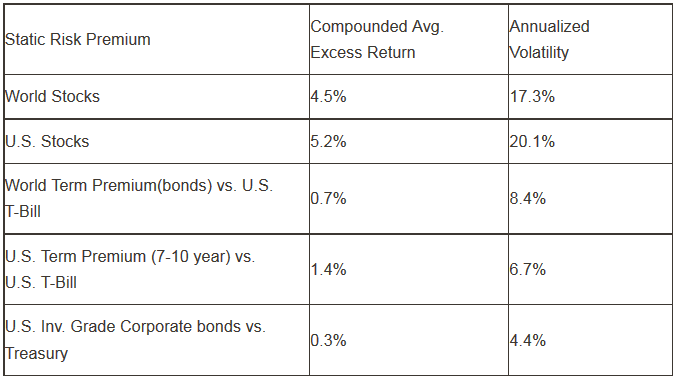

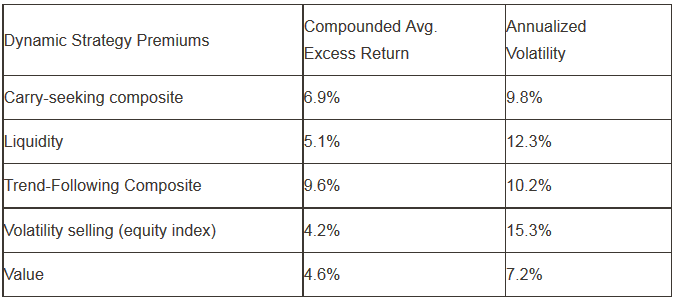

On November 2-3 of 2011 the CFA Institute and CFA France sponsored the Fourth Annual European Investment Conference in Paris, France. Antti Ilmanen, Ph.D. was one of the presenters. The title of his Presentation was Understanding Expected Returns. This month’s letter is based on this presentation as it appeared in the June 2012 publication CFA Institute Conference Proceedings Quarterly. One of the great advantages in the day to day routine of investment management is the freedom to study. In most professions, time allocated to study is frowned on by the bosses of the organization. But, in the investment management business, time for study is encouraged, in hopes that financial rewards will follow. This same freedom to study, however, is also one of the great disadvantages to a typical day in investment management.Because the volume of material available is so overwhelming, you can easily allow this freedom to take time and energy away from the daily work needed to fulfill your promises to your clients. Faced with the problem of time allocation, most of us in the profession of investment management will defer to short cuts. We tend to pay attention to those articles that reinforce our beliefs and skip those articles that are contrary to that belief. It was this self reinforcing short cut that led me to a recent presentation by Antti Ilmanen, a managing director of AQR Capital Management (Europe) LLP at the Fourth Annual European Investment Conference, held last year in partnership with CFA France. AQR Capital Management was founded in January 1998 by a group of Goldman Sachs, & Company alumni and has been led by Cliff Asness. Dr. Asness is well known in the world of investment management both for his academic work and his skillful management of AQR. For those outside the industry, Dr. Asness is better known for the home he is building—a 25,900 square foot house in Greenwich, Connecticut; complete with indoor swimming pool and tennis court. No doubt a library and office will take up a couple of square feet. Dr. Asness could not have created enough individual wealth to build his mansion without the help of some very talented professionals who were willing to give up a bit of the financial rewards of owning a business for the freedom to spend more of their day in research, with the full blessing of a management team. I believe Antti Ilmanen is one such individual. Having earned a Ph.D. in Finance from Dr. Asness’ alma mater the University of Chicago, he spent a decade with Salomon Brothers before moving on to Brevan Howard, a well known hedge fund from the United Kingdom. His articles have earned him a Graham & Dodd scroll and the Bernstein Fabozzi/Jacobs Levy award. His book, Expected Returns: An Investor’s Guide to Harvesting Market Rewards, was published last year. If you are interested, this 500 page book is readily available for your reading pleasure from your favorite book outlet. Knowing that reading a 500 page book on finance is not at the top of your to do list, I thought I would share with you a few of Dr. Ilmanen’s findingsas seen through the biased eyes of yours truly, a confirmed cheapskate who only wants to invest in bargains. His work shows that five investment strategies, value, carry, trend or momentum, volatility, and liquidity have worked well over long periods of time to gain diversification and reduce the dependency of returns on the stock market itself. Having worked well over time gives us no guarantee that they will work in the future, however it is worth our effort to learn a little about them and see if they could work for us. Carry Of the five, carry should not be a strategy used by individual investors. In its simplest form, carry investing involves borrowing at a low rate and lending at a higher rate in hopes that the interest earned exceeds the interest cost of borrowing. Institutions have developed multiple approaches to use carry in just about every major asset class. This sophisticated strategy requires a very large commitment of funds and the need to be able to withstand periods of dramatic losses that could easily wipe out years of solid performance. Liquidity Like carry, a strategy based on liquidity, or should I say illiquidity, is not for the majority of us. Common sense tells us that if we give up the ability to convert our investments into cash immediately we should be paid extra. As Dr. Ilmanen’s work shows this has held true over many years. The problem, like carry, is that you must commit an exceptional amount of cash that you will not need in order to obtain the rewards of illiquidity. Recently a number of firms have promoted the use of non-tradable real estate investment trusts to individuals to capture this extra return. Not counting the fact that the majority of these REITs rely on the use of borrowed money that has to be repaid before you profit, the minimum investment required for many of these programs can reduce your overall portfolio diversification, thus increasing your risk. Because advertising rules are changing, you will soon be seeing and hearing of the great opportunities that venture capital, hedge funds, private equity and other forms of illiquid investment programs can provide you. Think twice before commiting. Trend and Momentum A strategy based on trend and momentum is capable of use by sophisticated individual investors. Following trends is a form of market timing strategy – one investment at a time. Momentum strategy is normally used in a long-short strategy. The easiest to implement is buying last years’ winners while simultaneously selling last years’ losers. The reason these strategies work is based on psychology. Most of us feel very comfortable investing after our portfolio has increased in value, not after the market has fallen. If we owned shares in a company and the price has declined we can hold on, we could sell or we could buy more. Most individuals will hold or sell after a decline. On the other hand, most investors want to buy more of a good thing and a good thing in common stocks, at least in our minds, is only if the shares have gone up in price. These feelings, those of feeling good and buying more shares, or feeling bad and selling our shares, last for about a year. Around this time is when fundamentals take over, quickly reversing any over or under valuation. Following trends or using a momentum strategy has been shown to work, but has been almost impossible for an individual investor to follow. It seems we hang on to our shares well beyond the time that the process works, allowing a full circle to complete in capturing zero return. Personally, I feel very few people can successfully follow a trading strategy for long enough time to reap the rewards. Ultimately fear or greed will enter our minds and take away any potential gain. Volatility The final two strategies, value and volatility, should be understood and used if possible for your individual portfolios. Dr. Ilmanen uses insurance and lotteries to illustrate his thoughts on volatility. Major volatility in the markets causes investors to overpay for insurance against downside volatility and at the other extreme, make a very risky investment in hopes of a substantial gain— both of which reduce expected returns. This is what he says about insurance against market volatility: The best-known insurance strategies involve various methods of selling equity index volatility. Doing so earns good long-run returns but at the risk of huge losses when bad times occur. This is what he says about taking huge risks in hopes of huge payoffs: It turns out that the most volatile assets within every asset class offer surprisingly poor long-term returns. If the cost of insurance has exceeded the benefits and taking huge risks has had very little payoff, then what about the middle ground, where we accept some levels of risk in hopes of a small but meaningful increase in returns? Dr. Ilmanen gives us the answer: “Meanwhile, low-volatility assets offer surprisingly good returns for taking a small risk. Defensive investments often provide the same or perhaps better risk adjusted returns than their more speculative peers.” Most of you are thinking these statements are directly related to common stocks. But they also apply to bonds and CDs. His studies also give us this information: “…there is no reward for holding bonds with a maturity greater than five years and …that CCC rated bonds underperformed more highly rated credits.” Our own approach to investing in bonds and CDs has been to earn an average return of a five year yield over our lifetime. The problem today is that the beginning rates on all fixed income obligations are so low that the payoff for extending maturities is not enough. When and if rates rise so that their current yield exceeds the expected inflation rate, then we will begin extending maturities in our balanced accounts. Value Most of you know that I am a firm believer in value investing. Buying low just seems to make sense. Being reassured by study after study that value investing pays, I was not surprised by Dr. Ilmanen’s inclusion of value as a strategy worthy of your consideration. Value investing is simple to understand. It is buying an asset (stock, bond or any other type you can think of) at a price less than you determine its real value is today. This broad definition does not work very well in any type of academic study. Since data on common stocks is easy to obtain, you will find that the majority of the academic studies on value investing is limited to this asset class. In addition, most academic studies use a calculation of market price to the accounting book value of a company or the market price to the recent earnings of a company to identify value stocks. Dr. Illmanen uses prices to book multiples. According to Dr. Ilmanen the reason for the outperformance of value over time is behavioral. Here is what he said: “Various behavioral interpretations, however, may offer more compelling explanations for the out-performance of value stocks. Here is the main narrative. Value investing works within markets and in many other contexts because of the overpricing of the hope for growth. If there is high growth in a stock or sector or a country, investors tend to extrapolate further subsequent growth, resulting in high valuations. Typically, this expectation is followed by disappointment in the growth rate and return”. Common sense tells us to “buy low and sell high”. Why then, is it so difficult for each of us to accept that statement and put it to work for our benefits? Common stocks, especially individual common stocks, do not become low priced without a reason. Knowing the reason, determining if it is real or temporary, and then estimating how long it will take to correct the problem, opens the door to many opportunities for error. Most of us can understand the problems facing a company. Most of us can judge whether that problem is temporary or real. The reason most of us fail to be rewarded is that we cannot or will not hang on long enough for the problems to be corrected and reflected in a higher market price. The Results I wanted share with you Dr. Ilmanen’s results. He reported his results as excess returns up and beyond the returns earned by U.S. Treasury Bills. To have some meaning, he also provided the annualized volatility. The beginning dates used for each return is when the data became available. They range from 1900 for U.S. and World Stocks to 1990, the first year data on volatility was available. This table provides the long history of the market’s returns (ending December 2009) This table provides the long history of the 5 strategies (ending December 2009) Some Final Thoughts

We should all be aware of what has worked in the past. However, the only guarantee any of us can give is that things will change. Most of you know that in order to obtain higher returns you will need to assume some risk. What I find the most interesting of Dr. Ilmanen’s work is the reassurance to me that higher risk does not equate to higher returns. Most of us are far better off in the middle of the risk/reward spectrum. Sticking with quality stocks in combination with short to intermediate term bonds and CDs may not provide the highest short term returns. But it could very easily provide you with the highest returns you could achieve over a lifetime. Until next time, Kendall J. Anderson, CFA Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed