|

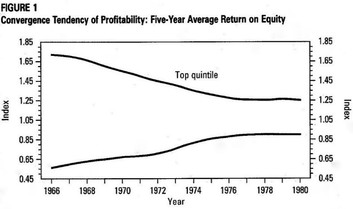

I often hear from many of you that you know very little about investing. However, I find that most of you understand investing quite well. Many of the concepts and theories thrown out by those of us who claim to be professionals can be restated into words and phrases you use regularly. For instance, when you say, “what goes up must come down,” or, when you are going through a particularly tough time, “don’t worry, things will get better,” you are showing your knowledge of regression to the mean. We have a deep conviction that things will return to normal with time. It is the driving force behind our security selection and portfolio management decisions. Because of that, I thought I would share some information on “regression to the mean” with you. Once again, I have sought a little help with this from my library, and am sharing with you an excerpt written by H. Bradlee Perry, CFA in 1987. At that time, Mr. Perry was employed by David L. Babson & Co., Inc. Babson was known as an excellent investment counselor and manager specializing in equity investments. The company published The Babson Staff Letter, which at the time was one of mine and many other investors’ favorite source of investment insight. The company still publishes the staff letter and it is freely available through the company’s website, www.babsoncapital.com. Although their business has changed substantially since the earlier days of the company, they are still highly regarded in the investment community. Of local interest, the company announced in May of this year that they are considering moving their headquarters to Charlotte, our neighbor city a few miles up the road. From The Babson Staff Letter, August 14, 1987, H. Bradlee Perry, CFA Stock Market Performance While it is easy for us to understand the concept of regression to the mean, it can be difficult for us individually to use this powerful force when we are investing our own money. We often do not want to sell when everything seems perfect, nor do we consider buying when things look bleak. Even if we do buy low, we often do not have the patience to wait and allow the business to make the changes needed to correct and improve their operations. Yet I know that if we can overcome these instincts, we will, as Mr. Perry states, improve our batting average.

Until next time, Kendall J. Anderson, CFA Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed