|

Some of us are bigger worriers than others. I worry over a very long list of things that mostly concern my son Carter. He currently has a lot of enthusiasm for cars. Sadly for me though, his most opportunistic hands-on car experiences involve parking lots. I worry a lot for Carter in parking lots, because of cars! I think most days his four-year-old enthusiasm is greater than my old dad chasing muscles. But I compensate for that worry with extra attention and that is the end of it. Some of us go through life with very little worry, while others leave the house wearing body armor. However, one thing almost everyone on that worry spectrum worries equally about is money! We worry when we are young and can’t save enough. We worry during our middle years about caring for the money we’ve saved. And almost without fail, we worry very late in life about what will happen to our money when we die. That is kind of a silly thing to worry about, since Saint Peter makes us leave it behind before passing the pearly gates, but it is almost an endearing worry when you think about it. We simply don’t want to be a burden on our loved ones late in life, and the idea that we may leave them with a difficult mess after passing is uncomfortable to us. So if you are one of those people who find this is one of your biggest concerns, I invite you to give us a call. Let’s have a meeting to see where you are in your planning… especially if you haven’t done any yet. We are here to help you plan now, but I assure you we will also help your spouse, children, brother or sister… or whoever it is you’ve named as your Personal Representative (Executor), when that time comes. Kendall, Libby, and I have done so several times in the past. I also want you to understand it is usually an easy process, especially with a little help. Our probate court is especially caring, thoughtful, and helpful. So begin lessening that worry if you have it. Look over this introduction to the Probate process and read through the checklist. If you want to know more, or would like to review or begin your estate planning, please give us a call and schedule an appointment. Probate is nothing to worry about. Sincerely, Justin Anderson Understanding Probate When you die, you leave behind your estate. Your estate consists of your assets — all of your money, real estate, and worldly belongings. Your estate also includes your debts, expenses, and unpaid taxes. After you die, somebody must take charge of your estate and settle your affairs. This person will take your estate through probate, a court-supervised process that winds up your financial affairs after your death. The proceedings take place in the state where you were living at the time of your death. Owning property in more than one state can result in multiple probate proceedings. This is known as ancillary probate. How does probate start? If your estate is subject to probate, someone (usually a family member) begins the process by filing an application for the probate of your will. The application is known as a petition. The petitioner brings it to the probate court along with your will. Usually, the petitioner will file an application for the appointment of an executor at the same time. The court first rules on the validity of the will. Assuming that the will meets all of your state's legal requirements, the court will then rule on the application for an executor. If the executor meets your state's requirements and is otherwise fit to serve, the court generally approves the application. What's an executor? The executor is the person whom you choose to handle the settlement of your estate. Typically, the executor is a spouse or a close family member, but you may want to name a professional executor, such as a bank or attorney. You'll want to choose someone whom you trust will be able to carry out your wishes as stated in the will. The executor has a fiduciary duty — that is, a heightened responsibility to be honest, impartial, and financially responsible. Now, this doesn't mean that your executor has to be an attorney or tax wizard, but merely has the common sense to know when to ask for specialized advice. Your executor's duties may include:

What if you don't name an executor? If you don't name an executor in your will, or if the executor can't serve for some reason, the court will appoint an administrator to settle your estate according to the terms of your will. If you die without a will, the court will also appoint an administrator to settle your estate. This administrator will follow a special set of laws, known as intestacy laws, that are made for such situations. Is all of your property subject to probate? Although most assets in your estate may pass through the probate process, other assets may not. It often depends on the type of asset or how an asset is titled. For example, many married couples own their residence jointly with rights of survivorship. Property owned in this manner bypasses probate entirely and passes by "operation of law." That is, at death, the property passes directly to the joint owner regardless of the terms of the will and without going through probate. Other assets that may bypass probate include:

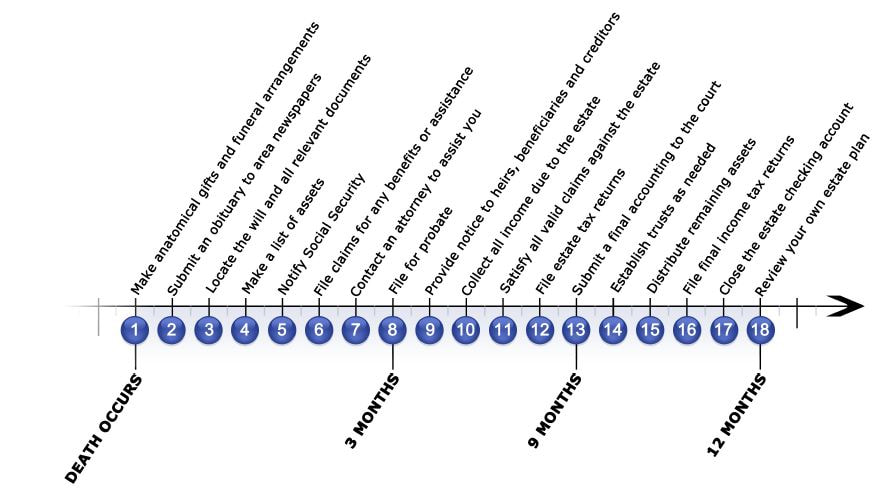

1. In the event the decedent made no provision for anatomical gifts, many states allow you to make that decision. In most jurisdictions, the funeral director can obtain certified copies of the death certificate for you (you will need several copies). 2. Word of mouth may not travel in time for the funeral. 3. Locate the will, birth certificate, marriage certificate, Social Security card, and any other relevant documents. 4. Note the location and value (you may need to retain an appraiser) of all real estate, insurance policies, jewelry, and other assets. Make sure assets are adequately insured. 5. Inform the Social Security Administration to stop payments that were being made to the decedent. Inquire about survivor's benefits. 6. Investigate the existence of any veteran's benefits, private pensions, or life insurance and make claims at this time. 7. Contact an attorney to assist you. He or she can help you determine whether probate is needed. 8. Petition the appropriate court for probate. 9. Place a legal notice in the paper to notify unidentified heirs and creditors. Contact named beneficiaries and known creditors directly. 10. For example, if the decedent owned investment property, rents will need to be collected. 11. This includes expenses, debts, and bequests (paid out in that order). Court permission may be required before writing checks through the estate account--keep meticulous records. 12. The federal estate tax return is due nine months after the date of death. State filing deadlines vary, so check with the appropriate state agency. 13. This is necessary to close the probate proceedings and relinquish the executor's duties. 14. Set up any trusts as outlined in the will. 15. Distribute remaining assets to all beneficiaries. 16. The federal income tax return is due on tax day (typically April 15) of the year following death. State filing deadlines vary, so check with your local tax office. 17. Notify the bank to close the estate checking account. 18. Review and update your own estate plan. Anderson Griggs & Company, Inc., doing business as Anderson Griggs Investments, is a registered investment adviser. Anderson Griggs only conducts business in states and locations where it is properly registered or meets state requirement for advisors. This commentary is for informational purposes only and is not an offer of investment advice. We will only render advice after we deliver our Form ADV Part 2 to a client in an authorized jurisdiction and receive a properly executed Investment Supervisory Services Agreement. Any reference to performance is historical in nature and no assumption about future performance should be made based on the past performance of any Anderson Griggs’ Investment Objectives, individual account, individual security or index. Upon request, Anderson Griggs Investments will provide to you a list of all trade recommendations made by us for the immediately preceding 12 months. The authors of publications are expressing general opinions and commentary. They are not attempting to provide legal, accounting, or specific advice to any individual concerning their personal situation. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2019. Anderson Griggs Investments’ office is located at 113 E. Main St., Suite 310, Rock Hill, SC 29730. The local phone number is 803-324-5044 and nationally can be reached via its toll-free number 800-254-0874.

Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed