|

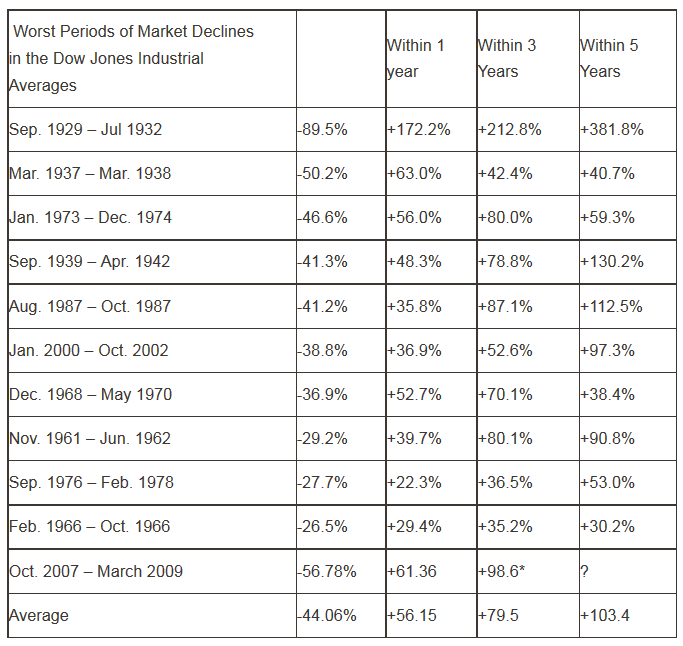

Executive Summary & Methodology I have been asked many times why we release our five year forecast in February, instead of December or January, the months when the majority of forecasts are released. The truth is the first time we shared our forecast was in the month of February, which has since turned into a tradition. For all practical purposes, we make a forecast each and every day, so February is just as good as December or January or any other month of the year. I seem to recall that Bill Miller, during his 15 year streak of market beating returns as manager of Legg Mason’s Value Trust wondered what all the fuss was about. He said that there where many times during this fifteen years that the fund underperformed the market depending on which month the performance calculations were completed. Of course, I have never taken the effort to determine whether this is true or false, but common sense tells me that it is highly probable. Just like all forecasters that have been around for a few years, we can claim our superior abilities when we are right, and hope that our failures are forgotten. And just as those who chose a calendar year to measure Bill Miller’s results, we can pick and choose those time frames where our predictions are superior and disregard those time frames when things just did not work out. The second question that seems to come up almost as often as “Why February?” is “Why do we project over the next five years?” To us, five years is short enough that we can see the end and long enough to eliminate most of the meaningless news and commentary that carries the greatest weight in day to day, week to week and month to month returns._ It may be that in today’s world of instantaneous reactions to all known events five years may, in fact, be too long. So we will rely on the words John Maynard Keynes, influential economist and successful investor, to help you judge our chosen time frame: “Long run is a misleading guide to current affairs. In the long run we are all dead”. As a firm, we respectfully submit these annual forecasts in hopes that they are of benefit in the intermediate term – before we are all dead. We believe that predicting short term swings in the market is an exercise in humility. Longer-term market predictions have value, but they should be based on a form of valuation methodology of the underlying securities that make up the market of choice. A consideration of the current mood of the market participants should also be included in that short term prices are driven by emotions. We don’t believe there are scientific factors which can be isolated and replicated to provide insight into short-term market predictions. However, we do know that over longer periods of time, the price of a security (or the total market value of all the securities in a market) will approximate the underlying capital retained and available for earning future income for its owners. This may not make much sense, so I’ll illustrate with an example. Wal-Mart is the world’s largest retailer. Most of us know the story of Sam Walton and his creation, beginning with just a single Wal-Mart store in 1962. In 1970, the company issued stock for the first time and raised $3,400,000. If the market never recognized the value of capital growth over time, then Wal-Mart would only be valued for $3,400,000 instead of the $212 billion that it is today. With that example in mind, it may be easier to understand that our approach in predicting market returns is based primarily on the analysis of current capital and the return potential of that capital,with a tentative prediction of the current mood of investors added on top. The tables in Appendix A and B may look confusing to you, but it gives us a basis for a projection of both the level of the market five years into the future, as well as expected returns in the form of dividends and growth of capital over time. Beware of taking this at face value, however.Our methods are based on a mathematical model which does not take into consideration human emotions, the primary driver of short-term market prices, both at the market level and at the individual stock level. These valuations will not mirror others because our calculation methods are based on a proprietary weighting method. The tables do not factor in any changes yet to occur which may affect prices or emotions. Given these caveats our projections would indicate the following: Our calculated return potential (Compounded Annual Growth Rate) for holding the S&P 500, S&P 400 and S&P 600 including dividends, ending five years from January 31, 2012 are: S&P 500: 11.76% S&P 400: 8.36% S&P 600: 7.34% Given the estimated returns as calculated, we are overweighting larger companies. We update our projections weekly. We not only complete this work for the S&P 500, S&P 400 and the S&P 600, but we also calculate an estimated return potential for each major industry sector. The constituents of each sector are companies that are currently included in the S&P 500 and whose industry is assigned by Standard & Poor’s. Our calculated return potential (Compounded Annual Growth Rate) of each sector, ending five years from 01-31-2011 are: Consumer Discretion: 8.14% Industrials: 9.55% Consumer Staples: 10.68% Materials: 10.86% Energy: 13.86% Technology: 13.05% Financials: 9.36% Utilities: 13.30% Health Care: 13.85% It is time consuming and takes both Justin and I together a full day simply to run the quantitative models. But what is more important to you is that these models are used as a guide in the overall direction of your portfolio. We use these numbers to compare one alternative to all other alternatives, and this is the real value of the work. Every day the market offers us a choice of where we can invest. By producing a quantitative study based on sound theory, a choice as to where to deploy our funds can be made on an apples-to-apples comparison. What about emotions? Emotions are and will continue to be the drivers of short-term demand for stocks and bonds. At the individual stock level, we believe we can isolate certain human traits which drive this demand. However, at the broader market levels, we believe that the method to judge emotions is more intuitive than quantitative. In other words, it pays to be somewhat of a contrarian and to try not to become a member of the Buy High/Sell Low Club. History of markets can be a helpful guide to understanding the emotions that have driven previous investor buying decisions after major market declines. Courtesy of Zacks Research and DTN.IQ *From March 6, 2009 through January 31, 2012

Since the March 2009 lows, the S&P 500 has gained 98% excluding dividends. This three year recovery has been exceeded only once before in 1932-1933. Does this mean that future advances are less likely to happen? Not necessarily. In fact, the gains over over the last three years took place without the benefit of individual investors. We believe it is very possible that individuals will once again embrace the benefits of common stock ownership and drive the averages higher. To reinforce this, the market’s recovery in the 1930s lasted until 1937. Following the 25% decline in October 1987, the market entered one of the greatest bull markets in history, lasting thirteen years. And as the above history shows, markets continued to produce solid returns for at least five years after a severe market decline. Even though market averages have increased rapidly since the March 2009 low, corporate profits have kept pace raising the potential return over the next five years slightly above the average returns that US stock markets have experienced throughout history. For most individual investors, the primary question is how much of my investable funds should I expose to common stocks (or some other form of equity ownership) versus lending my funds and being paid an interest payment for their use? The Treasury yield curve is a helpful guide. Daily Treasury Yield Curve Rates as provided by the U.S. Treasury on 01-31-2011 Maturity 1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr 20 yr 30 yr YTM 0.04 0.06 0.08 0.13 0.22 0.30 0.71 1.24 1.83 2.59 2.94 Given our quantitative work combined with history and the current level of interest rates, it would seem logical to maintain a commitment to common stocks. For those of you who are number crunchers and would like to speak with us in more detail about our quantitative work, by all means, give us a call. Kendall J. Anderson, CFA 01-31-2012 For more detailed information, please contact us at [email protected] for a copy of Appendix A: S&P 500 – S&P 400 – S&P 600 and Appendix B: Sectors. Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed