|

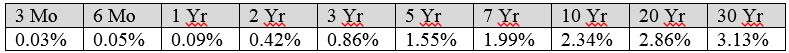

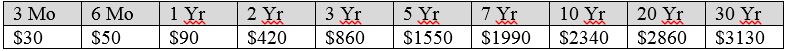

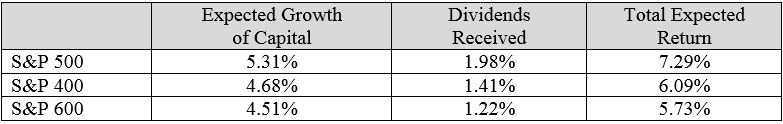

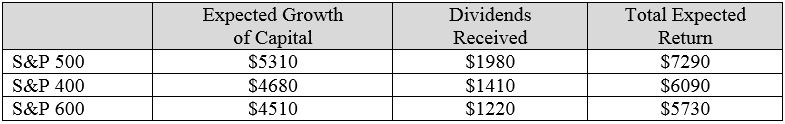

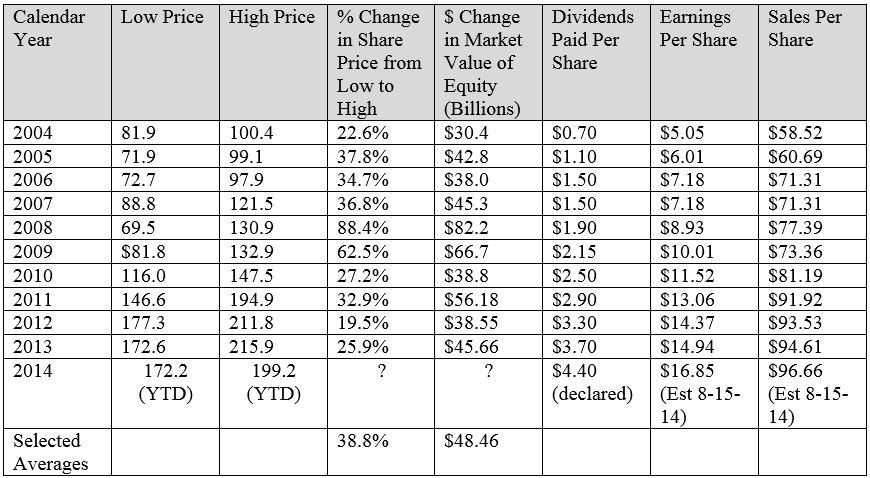

The other day I was leaving the office and a gentlemen who has known me for quite some time asked about the model year of my truck. I told him it was a 2001 and that it should still be good for another 100,000 miles. Of course my truck is known to me and many of my friends as “Big Red,” and it has become a family member of sorts, capable of and willing to take on any job, rather than just “a truck that hauls things around.” Over the years old Big Red has never left me stranded. His only request has been a big gulp of gas, some new oil every once in a while, and a set of tires when the old shoes wore thin. When it comes to taxes and insurance, Big Red gets a substantial senior citizen’s discount. Big Red will need to be retired at some point in the future. I am not sure when that will be; I can only assume he will let me know when the time comes. Behavioral scientists have studied the financial traits of people and have come up with all types of personalities. When it comes to me, they would probably take one look at Big Red and immediately classify me as a frugal person. To the scientist, a frugal person is one who has the tendency to acquire goods and services in a restrained manner and use them resourcefully to achieve a longer term goal. These behavioral scientists may just have described my approach to savings and investments, and “frugal” is a quite nice description. When I describe our investment process to other portfolio managers, they often call me a cheapskate! I have no problem with this, as I have said many times that buying low is the safest and possibly the most rewarding approach to building wealth. The current level of prices available for buying shares of public companies, or, for that matter, bonds of any sort, are far from cheap. With limited opportunities to buy low, I’ve become quite frustrated. However, this doesn’t mean there are no opportunities for a conservative investor. It just means we are having to work a little harder, dig a little deeper, and fend off the urge to buy something at any price just because we have the cash available today. Expected Returns from Bonds I want to share with you the current level of interest rates you can earn by lending your funds to the American citizens via the U.S. Treasury. As of August 15, 2014 U.S. Department of the Treasury To add real meaning, let’s see how much we would earn in cash per year by purchasing these various U.S. Treasury bonds at $100,000 each. For those periods less than 12 months, we will annualize the dollar amount as if we earned the same rate for the entire year. If we put $100,000 in a one year Treasury, by the end of the year we will have earned $90. After factoring in inflation, which is close to 2% now, we’ll have a guaranteed loss in purchasing power (0.09% - 2.0% = -1.91%). What happens if we decide to purchase a ten year Treasury instead? Will we be happy to earn $2,340 on our $100,000 yearly for the next ten years? What if interest rates return to 6%? Would we still be happy if our neighbor is earning $6,000 on their $100,000 loan? Although 6% may seem unlikely now, it is possible. Our country’s inflation rate has exceeded 2% on average for over a century. A margin of 3-4% above the inflation rate on a ten year Treasury bond is pretty close to normal. Expected Returns from Common Stocks Next I want to take a look at what we at Anderson Griggs Investments estimate the rate of returns will be in the broad common stock markets. We want to share our expected returns for the next twelve months for the S&P 500, a good representation of larger U.S. domiciled companies. In addition, we’ll share our expected returns for the S&P 400, representing middle of the pack companies, and the S&P 600, representing the smaller companies. For an explanation of how these returns are determined, see our letter titled “Our Five Year Forecast Beginning February 20, 2014…” posted to our website www.andersongriggs.com on April 7, 2014. As of August 7, 2015 Anderson Griggs Investments As we did with the returns from U.S. Treasuries, here are the expected returns in dollars for a $100,000 investment. If you compared the return potential of the broad markets with the level of interest rates of the U.S. Treasuries, it would seem to be a no-brainer to put all of your money in the market. $7290 a year looks a lot better than $90 for the same amount of money. However, that $7290 expected return on our $100,000 is just that, an expected return, without any consideration of the possibility that our calculations may be completely wrong. What if our calculations are way off the mark? What if there is an unknown problem brewing throughout the world that none of us can see today? How much could we lose? The answer is uncertain. If the future behaves as in the past, our $7,290 could quickly turn into a loss of $15,000, the normal downside volatility of the markets during any given year. Knowing that an investment in common shares could lose a large amount of our $100,000, and our “safe and certain” alternative will only give us $90 for a year, I am sure you understand why I am so frustrated. However, there always seems to be some opportunities available for the conservative investor who has the ability to see beyond tomorrow and wait patiently for rewards. If we do decide to commit our cash for future returns, the investment chosen should at least have the ability to preserve wealth and the possibility of producing a total return in excess of the expected returns from the market itself. Preserving Wealth with IBM I would like to share with you one company available to purchase today that we believe has the ability to meet these dual objectives. The company is an old friend of ours, International Business Machines (IBM). Over the years we have been able to buy this company at a bargain price and subsequently sell the shares at a price we would consider more than fair. International Business Machines Corporation (IBM) is a worldwide supplier of advanced information processing technology, communication systems, services and program products. IBM’s expertise is used to find customized solutions for business within its major segments – Global Technology Services, Global Business Services, Systems and Technology, Software, and Global Financing. The business spans the globe with over 65% of their revenues generated outside the United States. A Few Facts About IBM’s Share Price and Business Results Source: Value Line, Zacks Research and Anderson Griggs Investments

There are a few facts that this table highlights concerning both the business performance of IBM and the erratic nature of the public’s perception of value. As an owner of a business, we are entitled to all assets after all debt has been repaid (Equity Value of the Business), plus the future cash flow that the company will earn. If we look at the change in equity value above, we can see that the value of the owners’ equity changed on average a whopping $48 billion dollars a year between 2004 and 2013. This high variability of equity value makes little sense, especially in comparison to the performance metrics of IBM: a 10 year increase in dividend payout, a 10 year increase in Earnings per Share, and a 10 year increase of Sales per Share. We believe there is a disconnect between IBM’s earning capabilities and how the public values those capabilities. The critics of IBM point to the decline in revenues of the last couple of years. They emphasis that stock earnings per share are growing only because of share buybacks, and they worry that the current product offerings are “old-school” and unable to compete with the new kids on the block. These are legitimate concerns. Even so, if we commit cash to IBM at today’s price can we expect to preserve wealth and have the possibility to exceed our expected returns of the market? For myself and my clients, I am comfortable answering this question with a big YES. To preserve wealth we will need to produce an after tax return of 2% to cover inflation and taxes. Given the current dividend payment of $4.40, a yield of 2.34%, and little fear that the dividend will be reduced, we can assure ourselves that wealth preservation is met. Exceeding our expected rate of return of 5.31% is a bit more difficult to address. In order to achieve this the share price will need to appreciate from its current price of $187.38 to $197.33 within the next twelve months. $197.33 values the shares at 11.71 times the expected earnings for this year. Although there is never a guarantee that other investors will place this value on the shares, they have on average valued the company at 13.0 times the earnings for the past ten years. At 13.0 times earnings, the share price would be $219.05. Until next time, Kendall Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed