|

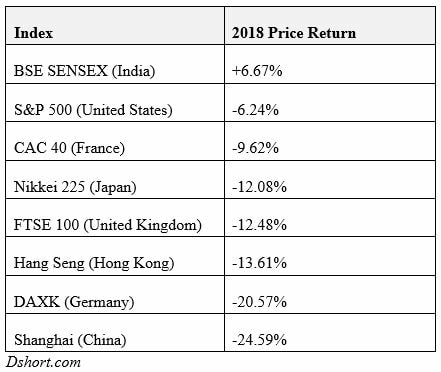

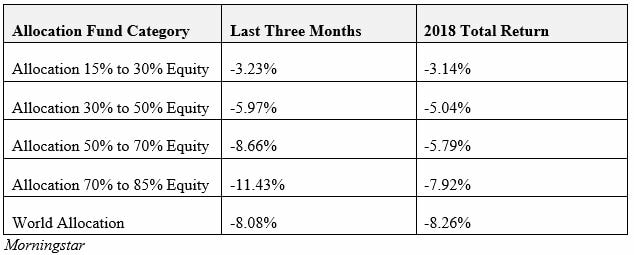

“Economic laws cannot be depended upon if we disregard psychology, etc.” -Alma Volker Alma Volker scribbled the note, quoted above, in the margin of a 1911 economics textbook, Outlines of Economics, written by Vassar College Professor Herbert Elmer Mills. Later her son, Paul Volker, who has served six presidents over his long career in public service, shared his regret of never discussing economics with his Mom in his recent book Keeping At It. This book may be Mr. Volker’s memoir, but to me it is a stark memory of my own history in the world of investment management. When he recalls those first few years after he assumed the chairmanship of the Board of Governors of the Federal Reserve System, I am drawn back in time to my own first few years in the business. It was during this time that I experienced first-hand the truth of Alma Volker’s note; psychology drives investor decisions far more than economics. When Mr. Volker raised interest rates to beat inflation out of our lives, it created one of the greatest opportunities for anyone with a few dollars to invest. You could easily buy a 10 year FDIC Insured CD paying over 15%. AAA Rated Municipal bonds paid over 14% for periods of 20 years or longer. Common stocks were priced at 7 times earnings (an earnings yield of 14%) while paying a 7% dividend yield. Yet few took advantage of this opportunity. After all, common stocks had done nothing but lose money for over a decade. The supposedly safe bonds paying 8% or more just a few years earlier were worth 35% less than when they were purchased. This proved to me that for us mere humans, any rational thought is bent by short term price movements. Through September of this year most of us were comfortable, as our portfolios were producing a positive rate of return. How quickly that changed as those positive returns rapidly turned into losses. Declines impacted investors around the world. Let’s take a look at the annual returns for a few major world stock markets as provided by Jill Mislinski of Advisor Perspectives for 2018: Granted, most of us will never have a portfolio that is 100% invested in common stocks. Nor would we own multiple index funds from around the world. Even a conservative investor who limits the amount of funds invested in common stocks had a hard time making any money in the past twelve months. Let’s look at the average returns provided by mutual funds that allocate money across various types of asset classes, the most common of which are stocks, bonds, and cash and or cash equivalents. These results are the simple average of allocation mutual funds that report results to Morningstar as of December 31, 2018: Price declines always need an explanation, even if the causes stated have little basis in reality. This time blame is centered around trade, interest rates, global growth, and a few other things always proceeded with the word “if.” A few examples for you: If tariffs are enacted, earnings will decline as costs increase and revenues decrease. If interest rates move higher, costs will increase, profits will suffer, and earnings will decline. If world trade is reduced because of tariffs and interest rates increasing, there will be no global growth. The world will suffer, and it will surely cause another great recession or dare I say a depression. If you have another explanation, please fill in the blank: If___________________________, we will lose all our money. Over the last four decades I have experienced many rapid price declines, and I am a bit cynical regarding causes. What I do know is that selling begets more selling, just as buying begets more buying. With the passage of time, prices will ultimately settle down at realistic prices that represent close to fair value. That is why greater than average returns have flowed to those few individuals who have the mental ability to buy when the majority are selling. Buying at a low price reduces risk and increases potential returns. For years Barron’s has invited a number of influential leaders in the world of professional investment management to participate in a roundtable discussion. Barron’s calls it their “annual investment talkfest and stockpickathon.” The rest of us know this annual gathering as “The Barron’s Roundtable.” This year, one of the new participants was Todd Ahlsten, chief investment officer of Parnassus Investments, and lead manager of the Parnassus Core Equity fund. He shared a story that I felt was worth passing along to you: My dad was a captain at TWA, where he was a pilot for 32 years. The company went through three Chapter 11 bankruptcy filings; he got laid off twice, and then the airline disappeared. That was my childhood. That’s credit problems. As dire as this conversation is, the U.S. is home to the greatest innovations in the world. Look at Googles and Amazons and Apples and Nvidias. We are still a creditworthy nation with great talent. We have diversity and population growth, and we still have immigration. I get that the numbers don’t look good, but this country has a lot going for it. Our banks are a lot better than some of Europe’s banks. They look better than Japan’s banks, and China’s. I’m going to bet that the diverse people in this room find great companies in which to make money. When everyone is thinking the worst about the future of this country, words like Mr. Ahlsten’s remind us why our country produces 20% of the world’s income with just 5% of the world’s population. Why buying and holding shares of financially sound American companies who innovate and grow their net worth has been rewarding for all of us who can withstand the ups and downs of auction pricing. You can be assured that we will continue to construct and maintain your portfolio to the best of our ability in order to meet your ongoing needs, no matter what the overall market may throw our way.

Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed