|

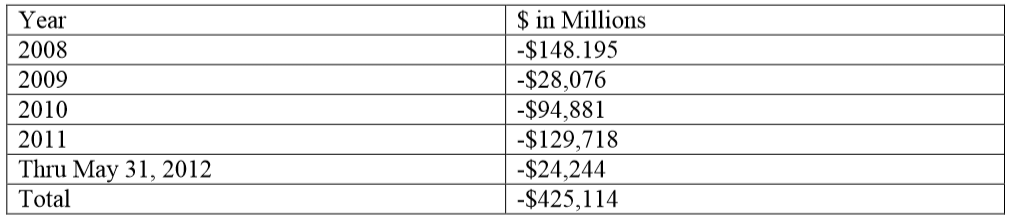

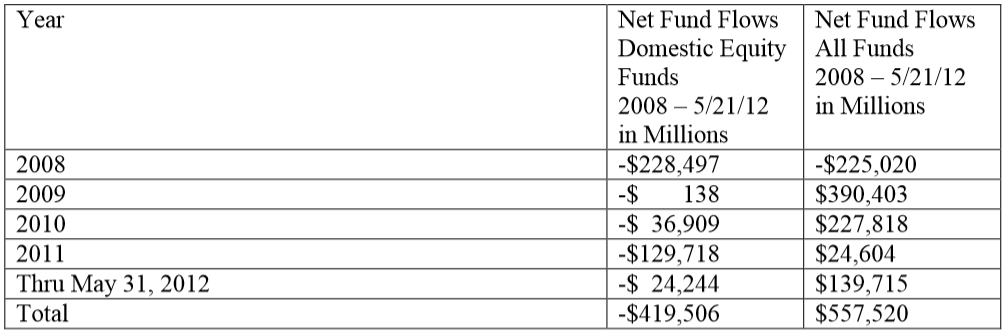

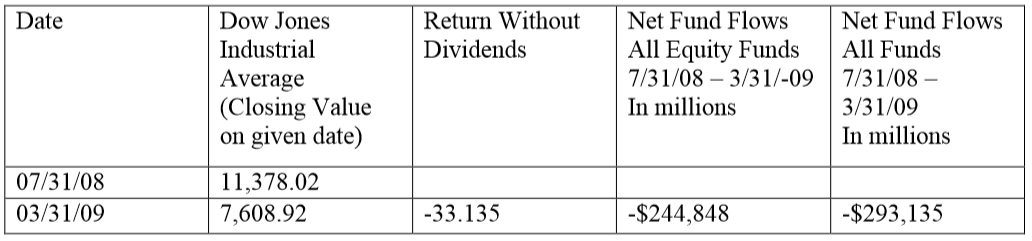

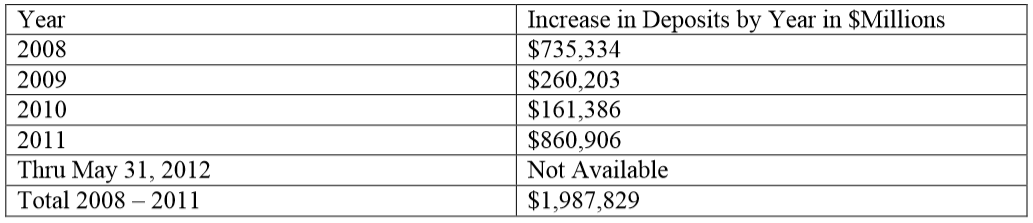

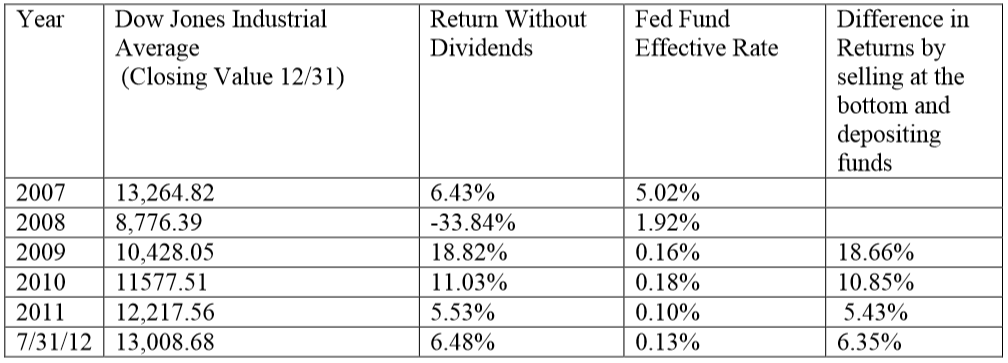

It has been a little over ten years since I sold my Corvette. Ten years is a long time, long enough that I should be able to see a Corvette drive by without feeling a sense of loss. The Corvette is one of the world’s greatest automobiles. My version was a black 1999 hardtop. The hardtop was billed as the most affordable model, as if there is such a thing. It came standard with a six-speed transmission, a race ready suspension and 345 horses under the hood that when let loose would either scare you to death or fill you with pure pleasure. Don’t ask me how I know that the 1999 Corvette could reach a speed of 150 miles per hour in less than a mile from a dead stop - just take my word for it! Sports car enthusiasts find a way to gather in groups on just about any occasion. Corvette enthusiasts are some of the best at this. A current owner, a previous owner, or someone who’s dream is to own a Corvette will become your best friend the minute they find out you are or were a proud owner. The 1999 hardtop was the first of its kind since the 1967 Sting Ray. Being the first in three decades the 99 car attracted a few more of these “best friends” than the average Corvette owners. One of these friends stated that I could make the car stealthy by tinting the windows and painting the wheels black. This confused me a bit. Tinting the windows and painting the wheels black would just make the car look more menacing than it already did. I can assure you that the Corvette, unlike the stealth bomber, cannot hide from a radar signal at all. In fact, I believe my corvette was built with a radar receiver, attracting the attention of every highway patrolman’s radar gun it ran across. Attracting radar signals can modify a person’s driving style. If you are thinking I parked my car and bought a moped you would be wrong. I still own a limited production high performance automobile and a couple of motorcycles that can get up and go. However, I did modify my behavior. Top speed is checked on a closed circuit course built for that purpose. I’ve added a GPS unit to the motorcycles that digitally display my speed up high so that I never have to take my eyes off the road. I’ve learned from my mistakes and have been rewarded by my insurance company with smaller premiums. The last few years have caused a number of us to modify our financial behavior. It is hard to believe that the financial crisis is over five years old. According to S&P Case-Shiller, the good times ended in June of 2006 when home prices peaked. By April of 2007 the big subprime mortgage lender New Century Financial Corporation filed for bankruptcy. Two months later S&P and Moody’s downgraded over 100 mortgage backed securities sending shivers throughout the banking and investment community. In less than a year, on September 15, 2008 Bank of America bought the great Merrill Lynch & Company, saving it from default. That same day, Lehman Brothers Holdings Incorporated filed for Chapter 11 bankruptcy. On the following day, American International Group (AIG) borrowed $85 billion from the U.S. Taxpayer to stay afloat. The list of bailouts, bankruptcies and government interventions has continued to this day. These problems have been handled quite well by the average U.S. citizen and U.S. based corporation. We have paid down debt, increased savings and repaired our balance sheets to a strength not seen in many years. In fact, the corporations have done an even better job. Not only are they in some of the best financial shape than they have been for decades, they’ve increased profits along the way. Even our banks, the hardest hit in the crises, have worked diligently to repair the damage. It seems that the average American also modified their investment behavior. Unlike the steps they took to improve their balance sheets, the steps they took with their investments portfolios did more harm than good. It’s as if they drove their car into the garage, shut the door and decided they would only walk from here on out. At the beginning of the financial crisis the Fed funds rate was set at 5.25%. By the time Bank of America acquired Merrill Lynch, the rate was down to 2%. By March of 2009 when common stocks were priced at their lowest valuations in decades, the Fed funds rate was at 1%. Today they are at 0% - 0.25%. From the beginning of the crisis and continuing to this very day, individuals and institutions alike have sold U.S. common stocks. Domestic Equity Mutual Fund Withdrawals by Year Of course this data represents only the funds withdrawn from Domestic Equity Mutual Funds. It does not include the mass withdrawal of institutional funds, separate account managers, insurance companies and individual security holders who owned the stocks directly. The Investment Company Institute keeps pretty good records on mutual fund flows. The common view is that individual mutual fund owners sold their U.S. stock funds and transferred their holdings to funds that invested in U.S. and foreign bonds. There is some truth to that. Net Mutual Fund Flows by Year What this doesn’t tell you is what institutions and individuals actually made or lost during the past five years since the beginning of the financial crisis. I’m afraid the average investor lost a huge sum of their savings through a combination of selling at the worst possible time and then refusing to add any new funds to common stocks, choosing instead to deposit their new money into the bank. Net Equity Mutual Fund Flows from the Beginning of the Crash to its Darkest Moment During the crisis people not only sold their stocks, they withdrew their money from all marketplaces.Had they reinvested into bonds or foreign stocks, the net dollars withdrawn could not exceed the dollar amount withdrawn from equity funds. Let’s take a look at bank deposits. Net New Deposits into Domestic Banks by Year As shown by the chart below, the difference in returns from staying the course (invested in the market) vs. earning interest on a bank deposit is quite dramatic. Dow Jones Industrial Returns and the Fed Fund Rate (A close approximation to interest paid on bank deposits) by Year Lessons Learned

Although it has been over four years since the market sell-off the fear it has caused is still fresh in our minds. It doesn’t help that we are reminded of it daily by a barrage of advertisements created by salesman who want you to buy gold, insurance policies, books and newsletters and an assortment of other sure fire ways to protect you in the next crash. Granted, it would be wonderful if we could find a way to have perfect timing. Today there are hundreds of people that will tell you and show you how their method could have protected you in the last crash. Well I could probably do the same thing. It is easy to be 100% right when you are mining data that already happened. I have no doubt that there will be another sharp and painful selloff in the future- the cause of which is not known today. We have had over two-hundred years of common stock markets. Throughout this recorded history of markets there have been a large number of crashes. I have personally lived through every one since the late seventies as a professional investment advisor, analyst and broker. Each one was caused by events the public never expected. And each one was followed by a period very similar to what we have experienced this time around. Broad market prices stopped falling! Broad market prices had a very sharp price recovery that lasted a year or two! After that prices continued to rise well above the prices reached prior to the crash. The majority of individual and institutional investors sold their investments and refused to reinvest. This action created permanent loss of capital that they may never see again. Those few individual and institutional investors that stayed the course have been rewarded with close, if not a full, recovery of value. And those very few number of individuals and institutions, those brave souls who continued to add new cash to common stocks in 2008, 2009, 2010, 2011 and this year, have been richly rewarded. Market prices can easily be higher in the near future There is one more lesson we have learned from past market crashes – and the payoff is still in the future. At some point a few of those individuals and institutions that sold common stocks and refused to reinvest will conclude that they were wrong. The appreciation in the market relative to what they have been earning on their funds will be too much for them to ignore. They will begin to buy. This will be followed by others. Once enough of these investors take this action the tipping point will be reached and the markets could appreciate quickly. If there is anything different this time it will be because the amount of cash available is larger than it has ever been in history. This sell off has not been isolated to the U.S. but throughout the world. Our U.S. bank deposits currently stand at $7.8 Trillion, up close to $2 Trillion in the last few years. U.S. mutual fund owners have sold over $400 Billion of common stocks, choosing to place those funds into investments earning close to nothing. The U.S. represents about 30% of world markets. Although I do not have figures on the rest of the world I believe we could easily have twice the cash sitting on the sidelines world-wide waiting to earn a reasonable rate of return. A good portion will find its way into common stocks. This reinvestment of cash and the transfer of bonds to stocks could easily raise market prices to all time highs. Enjoy the ride. Until next time, Kendall J. Anderson, CFA Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed