|

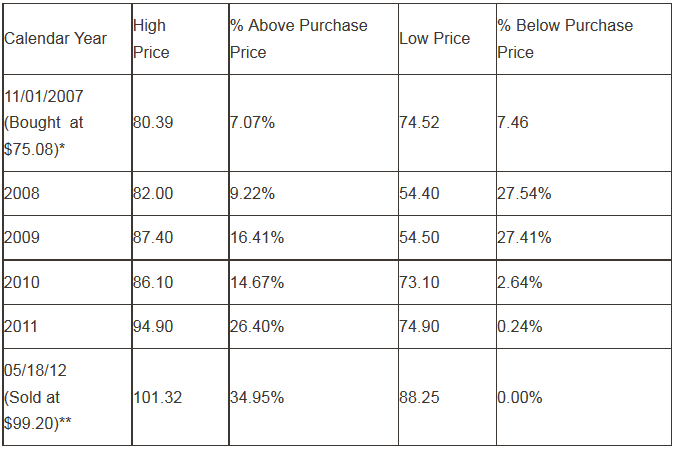

The Whims of the People Recently, I heard a discussion by a well known “media financial planner”, who, for years, limited her conversations to topics that she truly had knowledge of. Comments on tax planning, estate planning and protection against liabilities were always welcomed. But this conversation was different. All of a sudden, without warning, she had morphed into a portfolio manager, advising the rest of us how to speculate in the market based on her feelings concerning the economics of the world. Of course my thoughts were to tell this woman she had no business advising anyone on investing without training (or experience) in financial analysis, stock and bond selection or portfolio construction. But then again, when the entire world is making investment decisions based on headlines surrounding the evolving credit crisis in Greece and Spain, the European recession, growth in the U.S. economy, the financial cliff we will fall off when the Bush tax cuts expire, the slowdown in China, and the upcoming elections, why should I? She had just as much right to speculate with “other peoples’ money” as anyone else. And investing based on a feeling is just that – speculating. The fact is, for the past couple of years, financial analysis, stock and bond selection, and portfolio constructions have been trumped by the speculators who are currently in control of the markets. They can satisfy their risk on – risk off opinion easily and effortlessly via exchange traded funds. With just one or two trades, they can sell everything they own and replace it with something else within seconds. Of course, the ease that comes with trading stocks and bonds by bulk contributes dramatically to the increase in volatility. We see this daily, as the major indices advance and decline without any rational reason other than a “feeling”. I know the volatility will end at some point. We could just wait and hope that good financial analysis, good stock and bond selection, and proper portfolio management will carry us through the turmoil until rational investors return to power. But waiting based on a belief in human rationality is about as effective as making decisions based on a feeling. Most private financial decisions, whether they are to buy or sell a business, or to make a private loan to another party is based on the numbers not the whims of the parties. If you are buying an entire business, you would want to make sure that the cash generated by that business is sufficient enough to make a profit off your investment. If you are lending money you want to make sure that the dollars you lend will be repaid in full, with interest. Buying a small interest in a business via common stocks or lending your money to another by buying a bond in the open market is not so easy. Prices are set by the whims of the people that may not have any relevance to value. Being a numbers guy, my approach to volatility has been to ignore it. Not so with Justin. In fact he took it upon himself to study Psychology by taking courses at our local university. These courses have come to an end this year as he took so many that the University was forced to hand over a diploma granting him a degree in Psychology. His knowledge of how and why people make certain decisions has helped us immensely in the management of your portfolio. Understanding how and why people make decisions independent of the financial analysis of a business has already helped us preserve wealth at a time when so many others reacted to their emotions and created a permanent loss of capital. The Pain of Volatility Over the years we have shared our thoughts on investing as a business owner with you. The price we pay for a small ownership in a sound, operating business through common stocks is set by others around the world. We can accept their offer to sell us their ownership interest or we can ignore it. If we already own an interest in an operating business, others will offer to buy our ownership interest instantly via the market price. Once again, we can accept this offer or ignore it. The problem with most of us, is that we equate our wealth to the current offer price established today. When our share price declines we immediately feel the pain of loss. A normal person would react by minimizing the pain; i.e. selling their ownership interest. As you know, we recently sold our ownership in Colgate-Palmolive Company (NYSE – CL). A review of our purchase and sale may help you understand how reacting to market prices alone could easily lead to a permanent loss of capital. I don’t need to go into the details of the business as we all are familiar with the blue-chip qualities of Colgate, instead were are going to concentrate on the price changes over our holding period as shown in the table below. *For the period 11/01/07 through 12/31/07 **For the period 01/01/12 through 05/18/12

As you can see, every year the market, at one time or another, was willing to buy our shares at a price higher than we paid. It is also easy to see that during the first four years of our ownership, the market was willing to buy our shares at a price lower than we paid. Without confidence in the company (or our analysis) it would be difficult to hang on. Our total return from Colgate from our original purchase (it will differ for those of you with a different purchase date) was $24.12 plus dividends of $8.78 per share (43.82%). These returns came at a price – the psychological price of taking the pain every year as the market value declined below our cost. It would be nice if every company we owned had the same results as Colgate. However, we know this is not going to happen. Our own history shows that in a forty stock portfolio, five to six companies will be sold at a loss. Offsetting these losses will be five or six companies that exceed expectations. Colgate is an example of the rest of the portfolio that tends to produce our long-term returns. Congratulations to the Class of 2012 An intelligent investor would need a bit of courage with a large dose of confidence in his or her analysis to ignore the market price and hold on as we did with Colgate. It takes just as much courage to sell at a loss when our analysis is proven wrong. Justin’s knowledge of psychology is helping us understand how we think and make decisions, which is needed to improve returns. So let’s congratulate Justin and the next generation of thought leaders. Having attended multiple graduations for my wife, Kathy, and two or more for each of our three children, I could teach a good lesson on how to fall asleep during a commencement address. But this week, a written copy of an address was sent my way by another economic writer. I was impressed. So much so, that I want to share it with you as it was shared with me. Here it is. Until next time, Kendall J. Anderson, CFA ______________________________________________________________________________ To the Class of 2012 Neil Howe delivered the following commencement address at the University of Mary Washington on May 12, 2012. At a commencement address, speakers often go on too long. This I won't do. I may not succeed as well as Salvador Dali, who famously delivered the world's shortest speech, only four seconds long. He announced at the podium: "I will be so brief I have already finished," and then sat down. Commencement speakers also like to intone about "today's youth generation." And this is fine. Except that they then go on to talk at length about their own experiences in their own youth and tell you: Because this worked for me in my generation, it will work for you in yours. This should alert you that these speakers have no idea what a generation is. Let me clarify. A generation is a group of people who share a basic outlook on life shaped by their common age location in history, their common "generational setting." The renowned sociologist Karl Mannheim called this "eine Generationslagerung," which I promise you is both the longest word—and the only German word—that you will hear from me. "Youth," on the other hand, is just an age bracket. It's like an empty hotel room that different generations move into with their own baggage, and then soon leave. Sometimes that room swells with sweet music, sometimes it throbs with death metal, and sometimes it's utterly silent. But it's never the same. Bottom line: All of you Boomer and Generation X parents are essentially unlike your children—and were not the same even when you were kids. And you Millennial Generation graduates are essentially unlike your parents—and will not become like them as you grow older. So how, exactly, are you different? Well, start with the obvious: pop culture. Believe it or not, parents, your kids have never known that America, Chicago, and Kansas are the names of rock bands, not just places. Or what about technology? Ever notice the blank stares when you tell them roll up the window, turn the channel, or dial a number? Or what about current events? For as long as Millennials can remember, NATO has been looking for a mission, China has been peacefully rising, Brazil has been building shopping malls, and Boomers Bill O'Reilly and David Letterman have been hating on each other in plain view of millions. Now these markers are interesting, but if there's one big idea I want you to take away from my remarks, it's that generational differences go much deeper. Consider. You Millennials grew up in an era of rising parental protection, never knowing a time without bicycle helmets, electric plug covers, Amber Alerts, and fifteen different ways to be buckled into your minivan seat. We, the parents, grew up in an era of declining parental protection: Our moms and dads told us, "We don't care where you go so long as you're home for dinner." As for seatbelts, we were told if there's an accident to just throw up our hands to protect our heads. As kids, we never saw a "Baby on Board" sticker. "Baby Overboard" would have been more appropriate. You Millennials were raised to be special—very special—and to trust your counselors, support groups, and smart drugs to keep you feeling pretty good about the world, like a Sims character having just the right digital balance. We, the parents, knew we weren't very special, didn't trust anyone to advise us, and thought staying away from counselors was a sign of toughness. When you came to college, there were long orientations and immersions, and many of your parents clutched teddy bears and wept. When we came to college, we jumped out of the car and tried to grab our suitcases before our parents sped off. You Millennials were raised to be team players—and you are, with community service, group projects in the classroom, and clubs for everything. And, above all, you are team players with digital technology that connects you all to each other on Facebook, and smartphones that you take to bed with you. We, the parents, were a lot more into competition, rebellion, and defying the mainstream. We did not "friend" each other. Our generation invented the "personal" computer. Personal, as in "mine and not yours," and certainly not part of the corporate mainframe our own parents bequeathed to us. Growing up, our biggest fear was that Big Brother might someday install cameras in our rooms. Our biggest joy was hearing Steve Jobs announce that " 1984 won't be like 1984." And now, our biggest surprise has been to see our kids connect with each other by installing their own cameras in their own rooms! As a generation, you Millennials have a surprisingly conventional outlook on life. Surveys show that as you grow older you wish to become good citizens, good neighbors, and well-rounded people who start families. Violent youth crime, teen pregnancy, and teen smoking have recently experienced dramatic declines, and for that we congratulate you. Most startling of all, the values gap separating youth from their parents has virtually disappeared. You watch the same movies as your parents, buy the same brand-name clothing, talk over personal problems with them—and, yes, feel just fine about moving back in with them. When I travel around the country, I often ask people now in their 40s or 50s how many songs on their iPod overlap with what's on their kids' iPods. The typical answer is 30 to 40 percent. Let me tell you, back in my days on campus (later known as "the days of rage"), we did not have iPods, but if we had, the overlap would have been absolutely zero. Everything about our youth culture was intentionally hostile and disrespectful of our parents. That was the whole idea. People sometimes ask me, "What does it mean that one generation is different from another—that Millennials, for example, are different from the Boomers or Gen Xers who raised them? Does it mean that some generations are better than others?" And I say: No. There is no such thing as a good or bad generation. Every generation is what it has to be, given the environment it encounters when it enters the world. History shows that whatever collective personality a new generation brings with it is usually what society needs at the time. As such, youth generations tend to correct for the excesses of the midlife generation in power, and they tend to refill the social role being vacated by the older generation who is disappearing. To avoid speaking in code, let me rephrase this as follows. The Millennial Generation is correcting for the excesses of Boomers and Gen Xers who today run America. I need not remind you what those excesses are: leadership gridlock, refusal to compromise, rampant individualism, the tearing down of traditions, scorched-earth culture wars, and a pathological distrust of all institutions. The Millennial Generation is also reprising many of the hallmarks of the original G.I. Generation, the so-called "Greatest Generation," who are now passing away. Like the Millennials, the G.I.s grew up as protected children and quickly turned into optimistic, consensus-minded team players who, in the dark days of the 1930s and ‘40s, saved our nation from turning in the wrong direction at the wrong time. Igor Stravinsky once wrote that every generation declares war on its parents and makes friends with its grandparents. Yet again, that has happened. So all of you parents out there: Be proud of this new generation. They aren't like you, but they are what America now needs. They don't complain about the storm clouds looming over their fiscal, economic, and geopolitical future; they try to stay positive. They don't want to bring the system down; they're doing what they can to make it work again. They worry about you a lot. And they want to come together and build something big and lasting, something that will win your praise. Beneath their tolerant, optimistic, networked, and risk-averse exterior lie attitudes and habits that may prove vital for our country's healing and for our country's future. No one knows what challenges this Millennial Generation may eventually be asked to bear. Hardly anyone expects them to become America's next "Greatest Generation." But someday you can say you heard it from me: That is their destiny, to rescue this country from the mess to which we, the older generations, have contributed, perhaps a bit more than we ever intended—and, in so doing, to become a great generation indeed. Thank You. -Neil Howe Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed