|

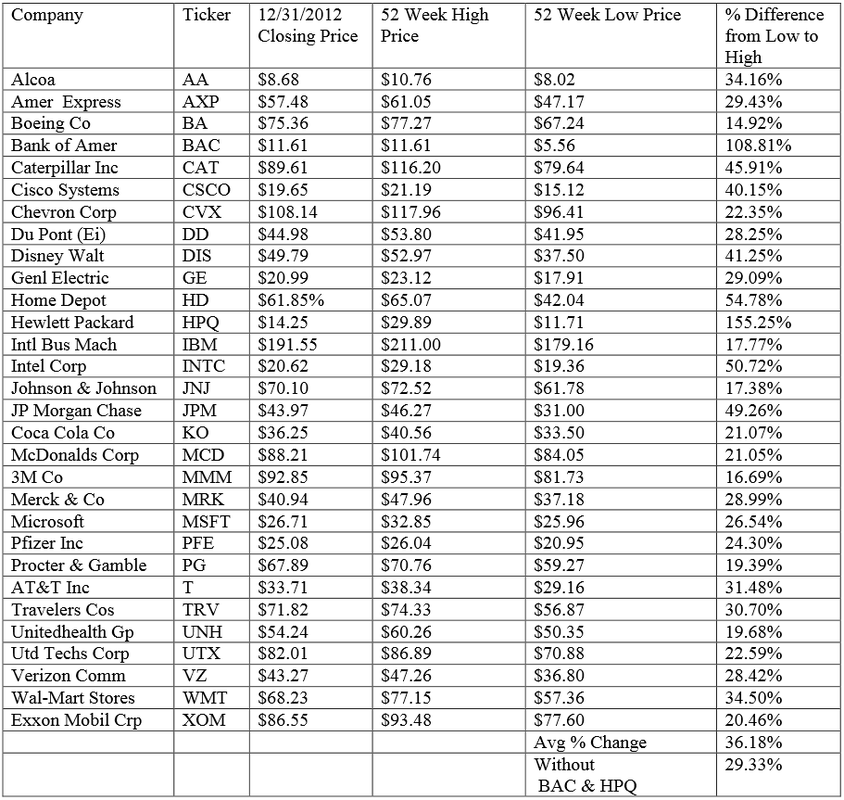

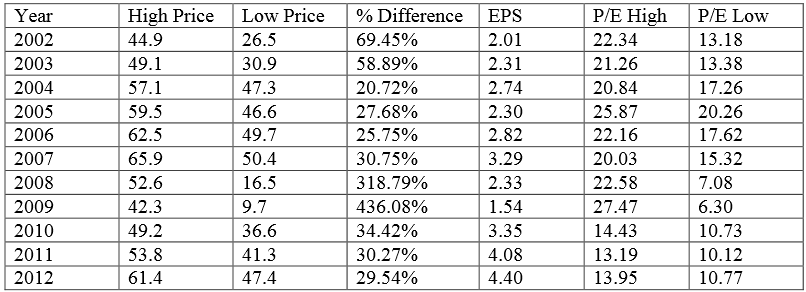

Eavesdropping I know it is not polite to eavesdrop on other peoples’ conversations, but, sometimes, I just can’t help myself. Once a week or so I get an urge to have my breakfast at lunch, so I take a short trip to our local Bob Evans where the cook knows how to prepare a couple of over medium eggs to my liking. One day, as I sat waiting patiently on my eggs, a couple sat down in the booth directly across from me. Normally, I would not pay much attention to them, letting them have their lunch in peace. But I faintly heard the word “investment”. Of course after hearing that, I just had to listen in. They looked like a nice couple, about my age. I made the assumption that they were married for a long time and were either recently retired or soon to be. The husband was explaining to his wife this wonderful investment opportunity that he had made or was about to make. When you eavesdrop you don’t always hear all the conversation. This was true with me that day; however, I did hear the words real estate, loans, and something about having to keep the investment for a long time. More importantly, I heard the wife clearly say, “as long as it has nothing to do with stocks”. Being an analyst I should know better than to make an assumption without a basis; but, in my mind, I just knew this couple did the same thing millions of other couples have done over the past few years. In 2008 or 2009 the pain of price declines was so great that they chose to sell their common stock holdings, creating a huge loss and swearing that they will never, ever, invest in stocks again. These memories are turning normal, intelligent people into very unintelligent investors. Price volatility has been with us forever. This includes price changes on common stocks, bonds, real estate, gold, interest rates and just about every other asset owned by investors. An intelligent investor can learn to embrace the opportunities the public markets provide. The greatest of which is the ability to instantly buy or sell an investments at a known price. In a non-public market, the total cost of an investment or the net proceeds from the sale of an investment is not fully known until the transaction closes. Dow Jones Industrials To emphasize the fact that volatility creates opportunity, we are going to take a closer look at the price change of the 30 companies that are included in the Dow Jones Industrial Average during 2012. Most of you will know these 30 companies by name. Each of them have a major influence on their industries and are widely held by both individual and institutional investors. For full disclosure, I personally own shares of American Express, Cisco Systems, Walt Disney, JP Morgan, 3M, United Technologies and Exxon Mobil. In addition, I have owned every one of these companies at one time or another throughout the years (and will probably own a number of them again in the future, as long as the price is right). Source: Zack’s Research A 30% change in market value is scary for all of us. We would not be human if we did not immediately think of losing 30% of our lifetime savings within a year. In fact, when it is upfront and personal, this thought of loss overtakes all thoughts of gain, which by the way could also be 30%. Before you panic, I want you to take a deep breath and think about your past investment experience. I am sure a few of you can recall the 30% declines in the value of your portfolio at the turn of the century and again just a few years ago. But what many people fail to realize, is that 30% swings in market price for any individual common stock has been close to the average for the past 200 years. This normal volatility is only memorable to us when the overall market declines. There have only been a handful of times that the markets declined by 30% or more in any given year. In addition, over this same couple hundred years the market average has produced positive returns around 9% annually, far more than the average return on government bonds, real estate, gold, or just about any other investment an average person can own. Knowing that volatility is ever present, an intelligent investor can simply wait until the price is low enough before purchasing. Marty Whitman, the legendary superinvestor, is famous for his “safe and cheap” approach to investing. My application of this “safe and cheap” approach is to buy quality at a low price, increasing our probability of preserving capital and earning a respectable long-term rate of return. A Simple Quantitative Review of American Express Company Of course, the key is to understand when a price is low! Even with three decades of experience valuing companies I can assure you it is not easy. In fact, it is fraught with errors, and since things change the valuation process never ends. I thought I would share with you a simple quantitative review of one of our holdings, American Express Company (AXP) using share price and earnings. Source: Value Line Publishing

I know you may be thinking this is just a bunch of numbers so I wanted to highlight a couple of things for you. First is the % difference column. After the tech bubble burst, the market continued to decline for a couple years. American Express was not immune to this decline which is reflected in the 2002 -2003 volatility. Again, in the financial crisis of 2008 – 2009, the world questioned whether any financial company would survive, including American Express. Excluding these periods, the average volatility of American Express’s share price was 28.45%, or just about the historical average of all companies. We originally purchased American Express in March of 2011 at an average price of $43.6532 per share, or 12.80 times trailing twelve month earnings of $3.41. At the time of purchase we did not know what the future held for this company. However, we did know that from 2002 through 2010 the only time shares of American Express could be purchased at a lower price relative to earnings was during a crisis and its aftermath. We also knew that every one of those years investors were willing to pay a much higher price relative to earnings than when we purchased the shares. There is far more to analyzing a company than this simple quantitative study. My purpose was emphasizing that common stocks average volatility is 30% year in and year out, and that the known volatility of prices allows an intelligent investor to pick and choose both the time and price of purchase. And finally, without some method of valuation, you can never claim to “buy cheap”. A Couple of Notes for You We will be sending you our privacy statement shortly. As always, it is pretty simple. We will not share any information about you or your account unless you have given us permission. Because our government can’t wait to collect a few dollars from you, I did not want to be in the way of your tax preparation. If you use a tax professional and would like us to provide them with details about your account please remember to call us and give us your permission. This month I will be interviewed by the Manual of Ideas. This will be a phone interview which I hope to obtain a copy of for your listening pleasure. If you are not familiar with The Manual of Ideas or their Value Conference, just do a Google search. Their January online newsletter features an interview with Jean-Marie Eveillard, a legendary global value investor and founder of the First Eagle Funds. In April, I will be a guest on the Mike Switzer show for his South Carolina Business Review that is broadcast on South Carolina Educational Radio. And, of course, every Tuesday we broadcast a short two to three minute program throughout the day on WRHI FM 94.3, South Carolina’s Radio Station of the Year. And one final thought—Justin has just received an additional 5% ownership in our company. He needs to earn that. So, if you get some time and you need any help at all, give Justin a call and put a little pressure on him. Tell him that with ownership comes responsibility and you are holding him responsible. Until next time, Kendall J. Anderson, CFA Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed