|

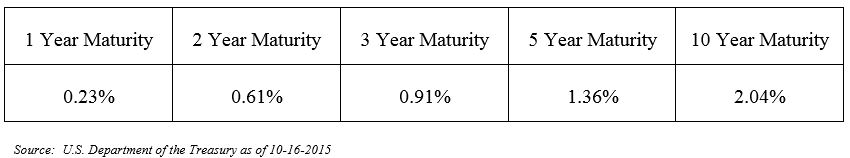

In a recent interview, Howard Marks, the great investor and co-chairman of Oaktree Capital, quoted the original Dr. Doom, Henry Kaufman, who once said “There are two kinds of people who lose money: those who know nothing and those who know everything.” Those of us who are selling investment services, whether portfolio management or investment products, have a tremendous ability to locate or create research that rationalizes our approach to building and maintaining a portfolio. Because we spend so much time and effort in this process we can become one of “those” who think they know everything, and as a result, disregard our primary purpose, which is to help people preserve and grow their wealth. This month, I want to share with you some thoughts on asset allocation. These views are contrary to the conventional approach that has been used quite successfully for decades; the basic stock, bond, and cash mix. The question we will try to answer is why cash is held in lesser amounts and only used to meet current needs or as an opportunistic buying reserve for stocks and bonds. Welcome New Members Before we begin, I want to take a moment to welcome all the new and returning members into the largest investment club in the world, the “Buy High, Sell Low Club.” Given the horrendous market returns beginning in August and running wild through the end of September, the club’s membership has grown so much that it can only hold meetings in cyberspace, as there is no location in the world that could accommodate all of the members. In my early years, I was a card carrying member of the club. I first joined in the seventies and rejoined again early in the eighties. I am happy to say that since I have again let my membership expire, I have been able to resist the urge to renew. I am just as happy to say that you have also been able to resist this club’s temptations. And if you haven’t noticed, since the end of September the markets have been recovering quite nicely. Some of you may think that resisting the club’s pull is easy. However, regret and the ever-present destructive forces of “should’ve, would’ve, could’ve” can be more agonizing than watching your portfolio value decline. For me, even though I have been rewarded with a very attractive long-term return on my capital, during those times when markets acted badly, I did not know when or if my portfolio would recover its value. I had to rely on my training, experience, and yes, faith that the businesses we own would find a way to grow their profits and dividends. If you feel at any time that the sirens’ call of the club is hard to resist, please let us know. We will do all we can to help, and together we will work towards finding a solution that we hope will be best for you. Asset Allocation I would venture to say that the majority of financial professionals believe asset allocation, not security selection, is the primary driver of portfolio returns. There are also just as many who think stocks are risky, bonds are safe, and cash has little use in a portfolio. Because of this, the majority of conservative investors think that bonds should hold the largest position in their investment portfolio. This belief is reinforced through the use of target date funds, which are held by so many individual investors in their 401K plans. Most target date fund investors take the time to read the literature which says the fund will be less risky as they get closer to their retirement date. This is accomplished by holding less stocks and more bonds. This belief is also reinforced by Jack Bogle, the well-known founder of the Vanguard Funds, who has over the years told individuals that their basic allocation to bonds should be equal to their age. If you are fifty years old, your portfolio should be invested 50% in stocks and 50% in bonds. At age seventy, it should be 30% in stocks and 70% in bonds. At age 25, you should have 75% of your money in common stocks and just 25% in bonds. This belief has also been reinforced by academics whose financial research influences the asset allocation of large pension plans, endowments, foundations and trusts. For a majority of institutional investors, a portfolio with 60% in common stocks and 40% in bonds is the norm. Variations from this norm are not taken lightly, and most are done only under the guidance of professional advisors who place bets on multiple alternative investments in hopes of earning superior returns. The greatest reinforcement of all has been bonds themselves. For the past thirty-five years, they have performed admirably, producing results that reassure investors they are safe. They have not lost money, and depending on when they were purchased could have increased capital, all while providing a respectable rate of return as readily spendable interest payments. With all of the good things bonds have done for investors, how could I have the audacity to suggest that a bond-free portfolio for individuals is appropriate, and that cash should replace bonds to reduce portfolio risk and increase returns? My thoughts on asset allocation were highly influenced by two individuals. The first I have written about many times, the great Benjamin Graham. Through his work I learned that the safety of capital is directly related to the price paid relative to the intrinsic value of both stocks and bonds. The second was Peter L. Bernstein, whose writings gave me some basic training in understanding the nature of risk and the primary place it holds in asset allocation. Benjamin Graham and Portfolio Policy Prior to reading Benjamin Graham’s Intelligent Investor, I thought very little about asset allocation, as I was far more concerned with the problem of feeding my family. This conflict caused me to do what many in our industry continue to do today: “sell what you can.” Armed with little training and having faith in the wisdom of the firm, I sold whatever product they happened to recommend at the time. I think all of you will agree that this is not the most intellectual approach to financial advice. In Chapter 4 of The Intelligent Investor, titled “General Portfolio Policy: The Defensive Investor” Graham writes this: We have already outlined in briefest form the portfolio policy of the defensive investor. He should divide his funds between high-grade bonds and high-grade common stocks. At the time of Graham’s writing, the options for the average investor were almost limited to individual common stocks, with only a few opportunities in high quality bonds. Of course the world has changed, and the explosion of new product introductions from the financial engineers on Wall Street allow almost everyone, even those with limited savings, to participate in hundreds of other assets beyond stocks and bonds. However, the majority of individuals today still use the basic stock/bond portfolio. And with the popularity of target date funds, I believe this will continue far into the future. The greatest change since Graham is the ability to earn a competitive interest rate on cash. Beginning with FDIC Insured deposits, including certificates and money market mutual funds, cash or “near cash” has become a major investment medium that is included in the majority of individuals’ portfolios. Peter L. Bernstein, Risk, and Diversification On just a few occasions I have shared the wisdom of Peter L. Bernstein with you. Even though I have some ideas contrary to his thoughts, there is no question of his influence on my understanding of risk, which shows in how we manage your portfolio. He is best known for his book, Against the Gods: The Remarkable Story of Risk, which sold over 500,000 copies worldwide and is still widely available. It should be required reading for all investment professionals. Bernstein was an investment manager, teacher, author, economist, and financial historian. In addition to ten books, he authored countless articles in professional journals. One of these, titled How True Are the Tried Principles?, appeared in the March/April 1989 edition of Investment Management Review. This short article had a significant influence on my investment approach to building and maintaining balanced portfolios for conservative investors. I want to highlight a few portions of this article. Mr. Bernstein states, without reservations, that “bonds should trade places with cash as the “residual stepchild” of asset allocation to reduce portfolio risk and improve returns.” This is controversial, as there is almost universal belief that bonds are “safer” than stocks and by default will reduce risk. Risk as defined by most academics is not a permanent loss of capital, but the volatility of the market value of a portfolio. To minimize risk, we therefore just have to reduce the volatility of the portfolio’s market value. The preferred approach to accomplish this is through diversification. Mr. Bernstein’s words about diversification: Let us consider for a moment how diversification actually works. Although diversification helps us avoid the chance that all of our assets will go down together, it also means that we will avoid the chance that all assets will go up together. Seen from this standpoint, diversification is a mixed blessing. Here’s a little reminder about covariance and your portfolio. If the market value of your stocks and bonds go up or down at the same time, then the stocks and bonds’ covariance is positive. If the value of your stocks go down and the value of your bonds go up at the same time, then the covariance is negative. To limit the volatility in your portfolio, you would want your bonds to produce positive returns when the market value of your stocks go down. Mr. Bernstein’s words about covariance: Consider covariance first. We know that the correlation between bond and stock returns is variable, but we also know that it is positive most of the time…Stock returns correlate even more weakly with cash, but such as it is, the correlation between stocks and cash is negative. Bonds and cash also correlate weakly, but the correlation here tends to be positive. Even though many of us believe when stocks go down, bonds go up, and vice versa, this has not been the case. Given that bonds fail as a diversifier to reduce risk, why do so many people hold bonds? The only reasons are that bonds, in most occasions, pay a higher current income than both stocks and cash, and historically have been less volatile than common stocks. Today is one of those few occasions when dividend yields on common stocks exceed those of bonds. The current dividend yield of the S&P 500 is 2.12%. Compare that to the yields on US Treasury Obligations: If bonds provide less income than common stocks, and the benefits from diversification are limited to only a few occasions that happen infrequently, can replacing bonds with the current near cash alternatives provide better long term results and reduce overall portfolio risk? Mr. Bernstein’s words about cash: Although cash tends to have a lower expected return than bonds, we have seen that cash can hold its own against bonds 30% of the time or more when bond returns are positive. Cash will always win out over bonds when bond returns are negative. As each of you are aware, we have let our bond holdings mature without reinvesting the proceeds, deferring to allocate our fixed income holdings in short-term bank deposits, CDs and, if available, stable value funds. The rationale has far more to do with our expected rates of returns of common stocks relative to bonds, and the increased risk of bonds in a period of low interest rates.

Given the current rates paid, bonds are very vulnerable to negative returns. If interest rates are higher in the near future, then the market value of the bond principal could easily fall well beyond the amount of interest income received. Cash, on the other hand, will not suffer at all. In fact if rates increase, cash will add positive returns to your portfolio. As for common stocks, the income received in dividends is likely to be much higher over the next ten years than it is today. If dividends do increase, as we expect, the market value of common stocks should produce positive returns at least equal to that growth in dividends. Bonds, however, will be limited to the interest rates paid today with no increase in income at all. Until next time, Kendall J. Anderson, CFA Comments are closed.

|

Kendall J. Anderson, CFA, Founder

Justin T. Anderson, President

Categories

All

Archives

April 2024

|

|

Common Sense Investment Management for Intelligent Investors

|

RSS Feed

RSS Feed